- Security

- August 25, 2025

Table of Contents

- Investor’s Guide to Avoiding Cyber Threats

- Why Passwords Are the First and Strongest Layer of Protection?

- How to Create Strong and Hacker-Resistant Passwords?

- Why Password Length Alone Isn’t Enough?

- Password Manager: Secure All Your Logins in One Place

- 2FA: The Extra Security Your Password Needs

- Common Password Mistakes That Increase Your Security Risk

- Password Hygiene: Keeping Your Digital Life Clean and Safe

- What To Do If Your Password Gets Compromised?

- Protecting Your Wealth Starts with Your Passwords

Let’s face it, investing today is easier than ever, thanks to the digital tools at our fingertips. But with that convenience comes a serious need for caution. As investors, we’re constantly logging into apps, tracking portfolios, and accessing sensitive financial data online. We are always looking for better returns, keeping track of market trends, and often not giving importance to that one thing that is keeping everything else safe. Our password security.

In this blog, we will keep things simple and walk you through some practical, easy-to-follow tips to help you manage your passwords wisely and protect what matters most, your investment. So let’s break down why smart password management isn’t optional anymore and what simple steps you can take today to protect your wealth from cyber threats.

Investor’s Guide to Avoiding Cyber Threats

Did you know that financial services are one of the top targets for cybercriminals?

According to a 2024 IBM report, the financial sector experiences over 20% of all cyberattacks globally, and most of those begin with stolen or weak credentials. That one password you didn’t put much thought into. For investors, this means your online brokerage, crypto wallet, or retirement dashboard could be a hacker’s next payday.

What makes you a target?

You might think cybercriminals only go after big corporations or wealthy individuals, but the truth is, anyone with valuable digital assets is a potential target. And as an investor, your online footprint likely includes several high-risk entry points that make your accounts especially attractive.

- High-value accounts: Investment platforms, trading apps, and crypto wallets aren’t just regular logins. They’re gateways to real money. And unlike a social media account, if someone breaks into your brokerage or crypto account, they can drain it in minutes. That makes your login credentials highly valuable on the black market.

- Stored personal information: Most investment tools store sensitive personal information. We're talking Social Security Numbers, linked bank accounts, tax records, and more. It’s everything a hacker needs to steal your identity or commit financial fraud. Once they’re in, it’s not just your money at risk; it’s your entire digital identity!

- Linked services: Your email might seem harmless, but consider how many accounts are linked to it. A breached email can be used to reset passwords, access two-factor codes, and unlock everything from your crypto wallet to your stock trading app. One weak link, and they’ve got the whole chain.

To take a real-world example. In early April 2025, AustralianSuper confirmed that four of its members suffered a combined loss of A$500,000 due to unauthorized access to their accounts via credential stuffing. Attackers reused stolen login credentials from previous breaches to infiltrate other accounts. Affected accounts totaled around 600

Why Passwords Are the First and Strongest Layer of Protection?

Your investment portfolio might be diversified, but is your digital protection strategy?

Think of your password as the security code to a vault. If that code is weak, reused, or exposed, it is as good as you’re leaving the door wide open.

Here’s a quick pulse-check:

- Do you use the same password across multiple accounts?

- Is your password less than 14 characters?

- Do you include your name, birth year, or simple patterns?

- Have you used the same password for over a year without updating it?

If you answered "yes" to any of the above, it’s time to rethink your approach and strengthen your defenses.

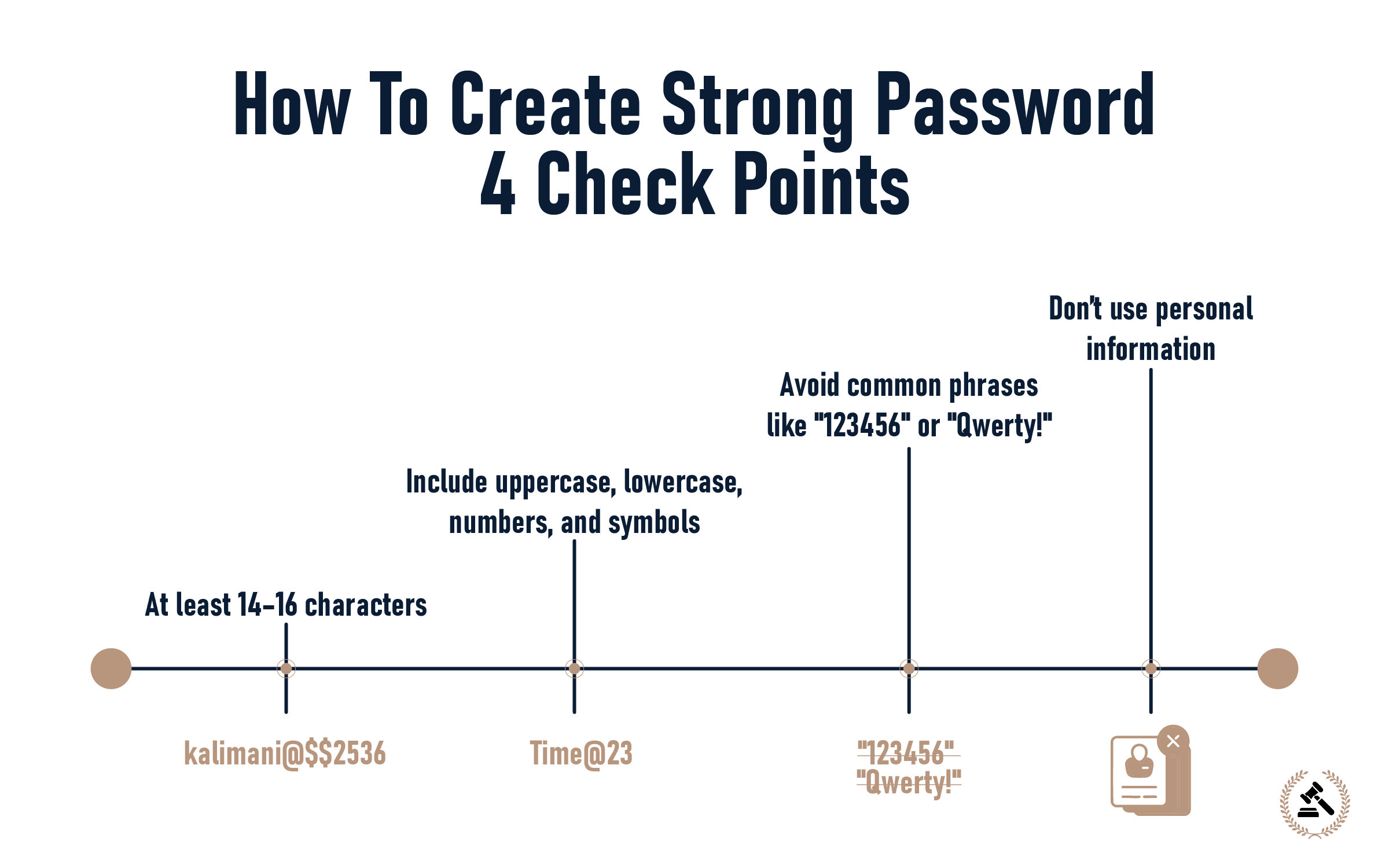

How to Create Strong and Hacker-Resistant Passwords?

Creating a strong password isn’t about adding more random letters; it’s about making it unpredictable, unique, and hard to crack.

Here’s what makes a password strong:

- At least 14–16 characters

- Include uppercase, lowercase, numbers, and symbols

- Avoid common phrases like "123456" or "Qwerty!"

- Don’t use personal information (names, birthdays, anniversary dates, pet names)

Why Password Length Alone Isn’t Enough?

As a responsible investor who handles sensitive financial information, it's tempting to think a long password is a safe password. But length, although crucial, isn't the only thing. What does matter is unpredictability.

A good password, or better yet, a passphrase, puts length together with randomness. Rather than using a mix of characters, use a phrase that's memorable to you but nonsensical to others. Something like:

InvestInGrowth@2030!

It's long, unique, and not something that would be included in a hacker dictionary. Applications such as Bitwarden's Password Generator can assist you with generating these passphrases easily and securely.

However, a warning: not every long password is secure. Consider this example:

qwertyuiopasdfghjklzxcvbnm123456…….

It may seem cryptic, but it's just a keyboard stretch, a pattern that's often found in breach data and is easily determinable for attackers.

The bottom line? Don't count on length. A really secure password is long, random, and unique. Anything less is a risk you don't have to take

So, you know how to create a strong password. Great!

Now what? Now, let us talk about how to keep them safe.

Password Manager: Secure All Your Logins in One Place

No matter how strong and unique your passwords are, if you can’t remember them, they’re basically of no use to you. Now, as you manage different investment platforms, crypto wallets, broker accounts, or fintech tools, it’s understandable to fall into the trap of reusing passwords or jotting them down on a sticky note on your desk. This is exactly where you need password managers, not just as a convenience tool, but as a safety net for your digital life.

On top of security, password managers bring a level of convenience that’s hard to ignore. They store all your logins in one secure place, protected by strong encryption, the kind even seasoned hackers struggle to crack. Most come with auto-fill features that save you from typing long, complex passwords every time you log in.

Thus, no more guesswork, no wasting your time resetting passwords or digging through notes. Just one master password, and you're in. A password manager makes access simple while ensuring strong protection in the background.

For investors, this is a game-changer. It helps you stay secure without the stress and makes sure each account can stand on its own. That means if one platform is breached, the damage stops there. Tools like 1Password, Bitwarden, Keepass or Dashlane also alerts you when your credentials appear in a data breach, giving you time to act before your financial world gets shaken.

Bottom line? A password manager doesn’t just make life easier; it makes your accounts much harder to break into

2FA: The Extra Security Your Password Needs

Two-factor authentication (2FA) adds a second layer on top of your existing password, and it’s one that hackers can’t easily break into. Even when someone gets hold of a password, they won’t be able to get in without this second layer, which usually comes in the form of a code sent to your phone, an app-generated token, or a biometric check.

Think of it this way: your password is your house key. 2FA is the security code on your alarm system. One without the other is a gamble you don't want to take.

Enabling 2FA isn’t just recommended; it’s non-negotiable for investors, especially those dealing with crypto, stock platforms, or high-stakes financial data.

Whenever possible, use app-based 2FA like Google Authenticator or Authy over SMS-based 2FA, which is more vulnerable to SIM-swapping attacks. A few extra seconds of your time could be what stands between you and a serious financial loss. Learn more about 2FA in our complete guide.

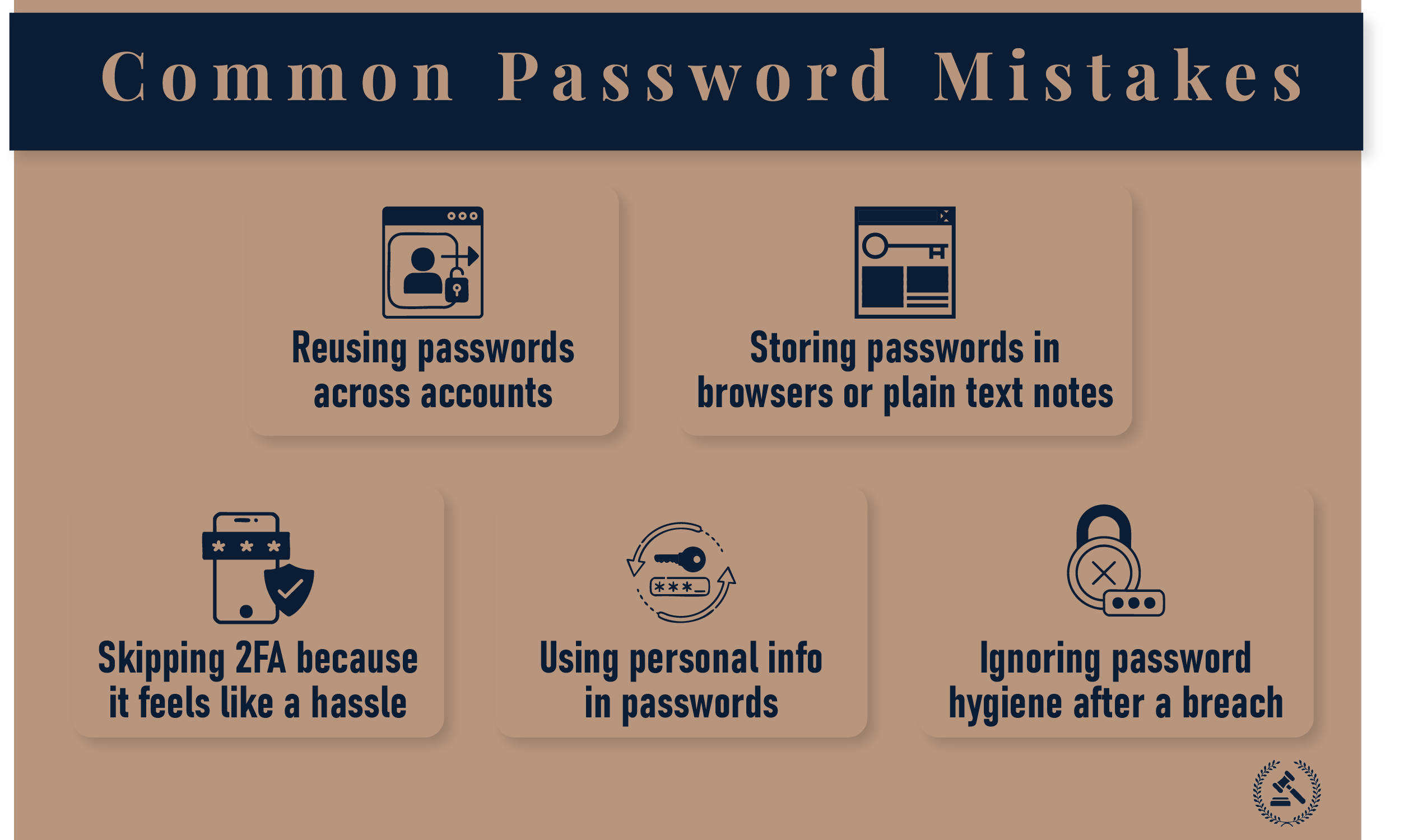

Common Password Mistakes That Increase Your Security Risk

Precautions are better than cure! Even the best intentions can go sideways if you fall into these all-too-common traps. So, here are some common mistakes to avoid.

- Reusing passwords across accounts: One breach opens the floodgates.

- Storing passwords in browsers or plain text notes: Convenience is the enemy of security here.

- Skipping 2FA because it feels like a hassle: That hassle could save you thousands.

- Using personal info in passwords: Birthdays, pet names, or favorite sports teams? Hackers know where to look.

- Ignoring password hygiene after a breach: If your data is leaked, change your credentials immediately, even if you don’t notice suspicious activity.

Security isn’t a one-time task; it’s a habit. And like any habit, it gets easier the more you practice.

Some of you must be wondering what password hygiene is!

Password Hygiene: Keeping Your Digital Life Clean and Safe

Good password habits are the first step to staying safe online. Just as financial institutions regularly audit and update their security systems, individuals, especially investors managing multiple accounts and large portfolios, must do the same with their passwords. Neglecting this practice can expose sensitive data and lead to significant financial loss. For investors managing several accounts, handling large portfolios, it's especially important to keep passwords fresh and secure. It's easy to get lazy, but weak or outdated passwords can cost you big time.

Also, take time to close out old or unused accounts. They’re like forgotten backdoors waiting for a hacker to sneak in. And finally, stay alert with monitoring tools or alerts that notify you of suspicious activity; a small heads-up can save big trouble down the line.

After all this, what if your password is still compromised?

What To Do If Your Password Gets Compromised?

Let’s say the worst happens, your password is exposed in a data breach or leaked online. Don’t panic, but don’t delay either. Speed is your best defense.

- First, change the password immediately, not just on the affected account, but on any other account that shares the same or similar login (though hopefully, you’re not reusing passwords).

- Next, enable two-factor authentication if it’s not already in place, it adds a critical layer of protection while you assess the damage.

- Check if your email or passwords have been compromised using tools like Have I Been Pwned. Its a brilliant tool, you just have to put in your email address and just with a click you can know whether your ID has been breached or not.

- If yes, you can take immediate actions. If it’s a financial account, alert your bank or trading platform right away.

- And keep a close eye on your statements and transactions for any odd activity over the next few weeks.

It’s not just about recovering access, it’s about staying one step ahead of potential financial fallout.

Protecting Your Wealth Starts with Your Passwords

As an investor, your attention is always on risk and return, but don’t let digital security become the weak link in your portfolio. From choosing strong, unique passwords to embracing tools like password managers and two-factor authentication, every action matters. Each small step you take adds up to stronger protection

This isn’t just about tech skills, it’s about protecting everything you’ve invested in. Imagine building wealth for years, only to expose it to risk by a single weak password. Sounds dramatic? It’s not. Cybercriminals don’t need a reason; they just need an opening. Your passwords are your first line of defense. Treat them like vault codes, not throwaway phrases. Because in finance, security isn’t optional; it’s non-negotiable. So update those logins, turn on that second lock, and take control of your online safety before someone else tries to.

FAQs (Frequently Asked Questions)

To increase your password hygiene, start with one important account, like your email or trading app, and update it with a strong, unique passphrase. Then try a password manager; most are beginner-friendly and guide you through setup. Finally, turn on two-factor authentication (2FA) if available. Small changes go a long way.

At least once a year for general accounts. For critical ones, like brokerage, banking, or crypto wallets, aim for every 3- 6 months, or immediately after any suspicious activity or breach alerts.

Yes, and they’re safer than storing passwords in a notebook or using the same one everywhere. A trusted manager encrypts your data and stores it securely. You only need to remember one strong master password. Bonus: many of them can auto-generate secure passwords for you.

To start small, you can use biometrics or App-based 2FA, like Google Authenticator or Authy is a strong choice. It's more secure than SMS-based codes, which can be intercepted. For high-value accounts, like investment platforms or crypto exchanges, consider hardware keys for the highest level of protection. Think of it as locking your vault with a real-world key.