- Cybersecurity

- September 9, 2025

Table of Contents

- What is Online Phishing

- How Do Phishing Attacks Work Today?

- Common Types of Phishing Scams to Watch Out For

- Why Phishing Is Getting Harder to Spot

- Red Flags: How to Recognize a Phishing Attempt

- Effective Tips: How to Protect Yourself from Phishing

- Real-Life Case Study: A Teacher’s Devastating Loss

- What to Do If You Clicked a Phishing Link

- Staying One Step Ahead of Scammers in 2025

Think phishing scams are old news? Wrong! These tricks are still around and getting worse. Even though people know more about online safety now, scammers keep finding new ways to fool us. They make fake emails that look like they come from your bank. They send text messages about packages you never ordered.

The scary part? These fake messages look more real than ever. Scammers study how real companies write their emails. They copy the colors, logos, and words that banks and stores actually use.

Here's what to watch for:

- Emails asking for your password or bank info

- Text messages about mystery deliveries

- Links that want you to "verify your account"

- Messages that say "Act now or lose your money!"

In this blog, we are going to learn why is phishing still a big problem? And what are the scammers doing to get a step ahead? And what can we do to ensure that we are not swallowed by phishing?

Let’s break it down and help you stay safe in a world where one wrong click can cost more than just your data.

What is Online Phishing

Internet phishing is when scammers pretend to be someone you trust. They might act like your bank, Amazon, or another company you know. These criminals are sneaky. They send fake emails and texts that look real. Their goal? To steal your personal info or your money.

Even though we have better security tools now, phishing is still a huge problem in 2025. The scammers keep getting smarter; this explains why the concept of phishing continues to thrive. It exploits fundamental human trust and behavior. Even an experienced digital security professional can easily fall into a trap.

Modern-day scammers actively employ advanced AI-based functionality and Phishing-as-a-Service (PhaaS) service. Malicious users, both skilled and unskilled, can use them to launch very effective and massive attacks.

The magnitude of this problem can be highlighted with the help of striking statistics of phishing scams that contributed to 36 percent of all data breaches in the period between 2022 and 2024. Moreover, it is estimated that on average, 3.4 billion phishing emails are sent daily, and this constitutes roughly 1.2 percent of all email traffic.

These numbers show just how relentless phishing has become, reminding us that no inbox or online account is completely safe. To truly understand why it’s so effective, let’s take a closer look at how phishing attacks work today

How Do Phishing Attacks Work Today?

Recent phishing attacks follow a standarphishing isp plan:

- Bait: You receive a message, it might be an email, a text, or even a phone call, that appears to come from someone you know.

- Hook: This message contains a dangerous link or attachment, usually with an emergency warning such as "Your account is locked!" or "Payment needed now."

- Trap: When you click, it redirects you to an imposter website to capture your passwords, banking information, or other personal data.

Modern-day scammers are the clever ones. They use tricks that play on an individual's fear or curiosity, even creating realistic messages and images using AI. With the rise of "Phishing-as-a-Service" (PhaaS) kits, it is basically child's play to conduct such attacks. These prebuilt kits facilitated over a million phishing attacks in a period of just two months in 2025. They are even clever enough to bypass standard security protections such as Multi-Factor Authentication (MFA) and use encryption to hide their tracks.

Brand impersonation is enormous. Microsoft and Amazon are definitely top spoofs. These days, phishing is no longer constrained to emails alone. Scammers deploy QR codes (quishing), text messages (smishing), phone calls (vishing), and fake social media alerts to lure victims. In fact, 41% of these attacks exploit multiple channels to reach you.

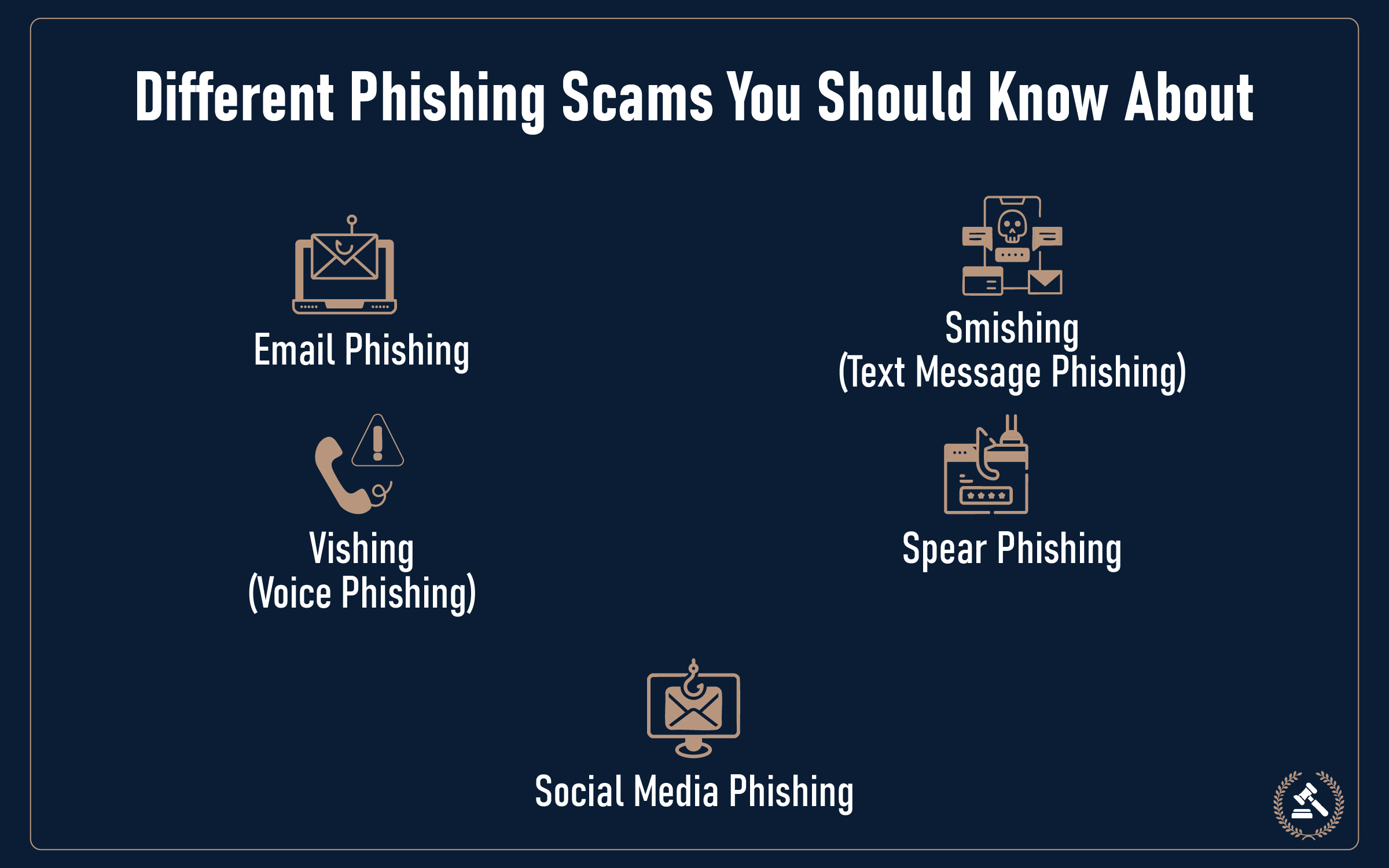

Common Types of Phishing Scams to Watch Out For

Scammers are always inventing new ways to trick you. Here are the most common types of phishing scams you need to be aware of in 2025:

- Email Phishing

This is the old scam. You receive an email purportedly from your bank, a delivery company, or even your boss. It typically tries to create a sense of urgency, telling you your account is suspended or you have a pending bill.

Its aim is to trick you into clicking a malicious link or opening an attachment that takes you to a phony site or installs malicious software.

- Smishing (Text Message Phishing)

Smishing is done via text messages. You may receive a message saying your package has been delayed or that your bank requires you to verify a transaction. These messages usually contain links to spoofed login pages. Because we generally trust what we read on our phones, these cons are quite easy to trap someone.

3. Vishing (Voice Phishing)

In a vishing scam, all you receive is a call that pretends to be tech support, the bank or even the police.

They may say that you have a fraud on your account or that you owe the money. The scammer will urge you to make an immediate action either by sending your confidential details or by paying up.

- Spear Phishing

Spear phishing is scary because it feels so real. Scammers will do a study on you first. They will know your name, where you work, or something you posted online recently.

Then they send an email that seems to come from your boss or a coworker. It might say something like "Hey Sarah, I need you to send me the client list right away for the meeting." It sounds normal, but it's a trick.

These messages work because they use details about your real life. The scammer spent time learning about you to make the fake message believable.

- Social Media Phishing

Scammers love social media sites like Facebook, Instagram, and LinkedIn. They send messages that look exciting or scary:

-

"Congratulations! You won a $500 gift card!"

-

"Warning: Your account will be deleted in 24 hours"

-

"Someone tried to log into your account"

They want you to click a bad link or type in your password on a fake website. Don't fall for it, real companies don't give out prizes through random messages.

6. QR Code Phishing (Quishing)

Quishing leverages QR codes as a vector of deception. A deceptive QR code could be placed inside an email or on a physical leaflet, which would result in a phony website when scanned. The inherent challenge of visually examining the destination of a QR code presents a subtle and potent way of hiding malicious links.

Why Phishing Is Getting Harder to Spot

The landscape of phishing scams has gone through dramatic changes, slowly evolving from crude, clumsy scams with obvious imperfections into highly polished scam emails that the average user cannot easily distinguish from legitimate communications.

1. AI-Generated Messages

Scammers now use smart computer programs to write their fake emails. These programs can write messages that sound completely normal without and grammatical errors.

Even worse, these programs can copy how your boss or coworker writes emails. They make fake voice messages and videos too. It's getting really hard to tell what's real and what's fake.

2. Lookalike Websites and Email Addresses

Scammers create websites that look just like the real ones. They might change just one letter in the web address. Instead of "yourbank.com" they use "yourbank-security.com" or "yourbankk.com."

Most people don't notice these tiny changes. The fake site looks exactly like your real bank's website.

3. Utilizing Trusted Platforms to Host Scams

Some of these phishing links are installed in applications which users habitually use and trust. They might send you a Google Form or a Dropbox link that looks normal.

Since you trust these apps, you don't think twice about clicking. But the form or file is actually stealing your information.

4. Phishing-as-a-Service (PhaaS)

Believe it or not, phishing is also offered as a service. Scammers can purchase pre-made packages that feature lookalike log-in pages, templates, and even "customer support" to execute their scams.

This makes it easy for even amateur criminals to execute very authentic-looking phishing campaigns.

5. Attacks Occur Over Multiple Channels

Scammers don't just use email anymore. They might:

- Send you a text message

- Call you on the phone

- Message you on Facebook

- Even use QR codes you scan with your phone

Sometimes they use all of these together. You get an email, then a phone call that seems to confirm it. This makes the whole thing feel much more real.

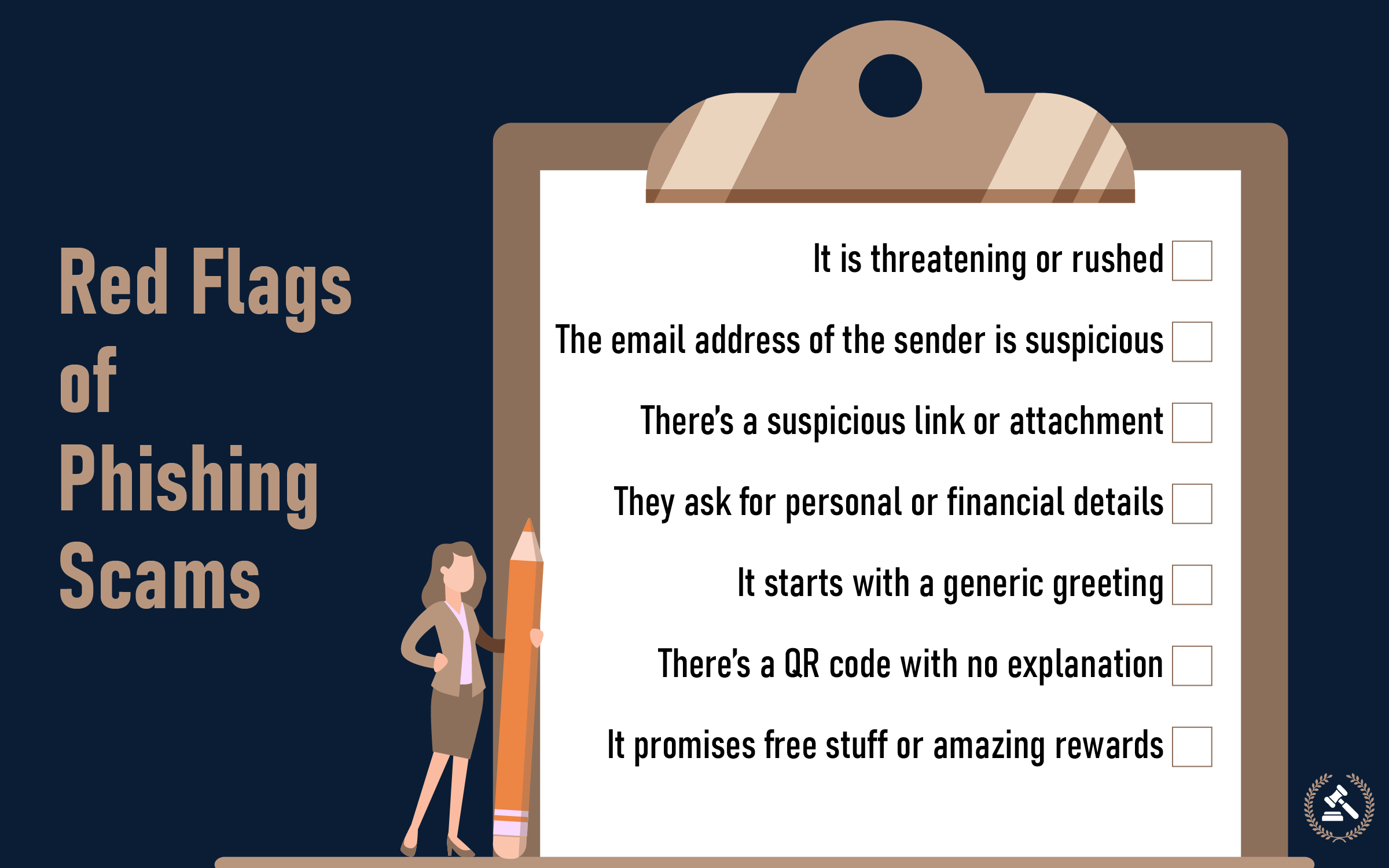

Red Flags: How to Recognize a Phishing Attempt

Not certain whether that message in your mailbox is legitimate or a scam? Use this speedy checklist to identify widespread indications of phishing. Even if one of these seems suspicious, do not click, slow down, and verify.

- It is threatening or rushed: Messages that indicate something such as "Your account will be locked," "Immediate payment is needed," or "You'll be taken to court" are meant to threaten you into quick action.

- The email address of the sender is suspicious: Examine the email address carefully. Is it cluttered with additional characters, misspellings, or an odd domain name? An email from your bank shouldn't be sent by a "support-secure@banc-login.com" address.

- There’s a suspicious link or attachment: Before clicking anything, hover your mouse over the link to see where it really leads. If it looks strange or doesn’t match the official website, don’t click. Attachments you weren’t expecting can also be risky.

- They ask for personal or financial details: Legitimate companies almost never ask for things like your passwords, card numbers, or PINs over email or text.

- It starts with a generic greeting: If the message says "Dear customer" instead of your actual name, that’s a red flag. Most real companies personalize their emails.

- There’s a QR code with no explanation:QR codes in emails or PDFs can hide malicious links. If you’re being asked to scan one without clear context, it’s best to avoid it.

- It promises free stuff or amazing rewards: If it sounds too good to be true, like winning a prize you never entered for, it probably is.

The Golden Rule: If something feels off, pause before you click. A few extra seconds can protect you from a costly mistake.

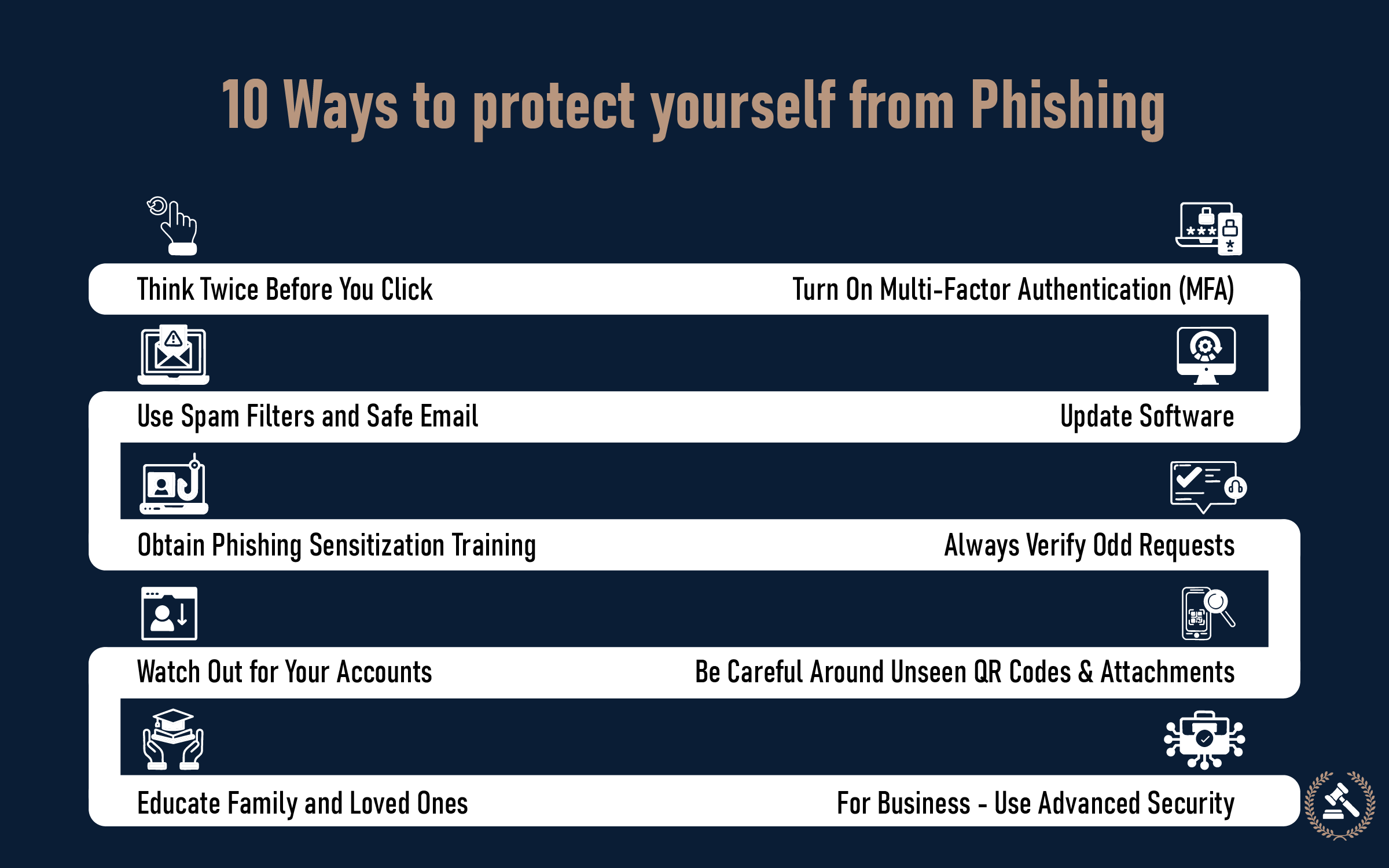

Effective Tips: How to Protect Yourself from Phishing

While phishing scams are becoming more cunning, you're not helpless. Here are real-life tips that really work:

- Think Twice Before You Click: Always double-check who sent the email and where any links actually go before you do anything with them.

- Turn On Multi-Factor Authentication (MFA): Use MFA (like a code sent to your phone) on your email, banking, and social networking accounts or use biometrics to access your accounts. This adds an extra layer of security even if an attacker obtains your password

- Update Software: Regularly update your computer's operating system, web browsers, and email software. These updates fix security holes that can be exploited by attackers.

- Use Spam Filters and Safe Email: Make sure your email spam filters work well. Employ email providers with strong security protocols.

- Obtain Phishing Sensitization Training: It really does work! Companies that educate their staff have seen a dramatic decrease (as much as 86%) of people opening phishing links within a year.

- Always Verify Odd Requests: When you get an email asking for payment or sensitive actions, don't act immediately. Instead, call the individual (like your bank or a vendor) on a number that you know is real, not one from the strange email.

- Be Careful Around Unseen QR Codes and Attachments: Handle any QR codes or attachments that you haven't expected with extremely utmost prudence. Don't download or scan them.

- Watch Out for Your Accounts: Monitor your bank statement and online account transactions closely for unauthorized or unusual activity.

- Educate Family and Loved Ones: Share what you've learned about phishing with your family members, especially older ones or kids who may not know how dangerous these are.

- For Business - Use Advanced Security: If you are part of an organization, apply "zero-trust" security (no default-trusted one) and threat detection software on all computers (EDR).

Real-Life Case Study: A Teacher’s Devastating Loss

Russell Leahy, a 28-year-old Texas teacher, was the epitome of financial wisdom and a cautious nature. He was not likely to indulge in risks or ignore warning signals. Though cautious, he got a misleading message, which appeared to be from his bank, stating that his account had been hacked and needed an urgent transfer of funds to a "safe account."

The email was full of signs of genuineness; the follow-up phone call was professionally made; and the sense of urgency communicated was overwhelming. Russell, under this tremendous pressure, went along with the instructions.

In a matter of hours, all his life's savings, totaling more than $32,000, were gone. It was years of commitment, early mornings, extra tutoring sessions, and lost vacations. It was the potential down payment on a house, he worked so hard to accumulate.

Realization of the scam hit him with a deep shock and disbelief. He called his bank, but most of the money could not be recovered. Even after filing complaints and making countless calls, most of the damage was irreversible.

The aftermath was not only plagued by extreme financial hardship but also by intense feelings of anger and shame. Russell was made to feel foolish, despite being an innocent victim. The con artists had carried out their fraud perfectly, leaving him to struggle with the consequences.

Still, he decided to voice his concern, going public about his traumatic experience in an attempt to deter others from going through a similar experience. "If it can happen to me," he said, "it can happen to anyone."

This was not just a scam; it was a theft of peace of mind, trust, and years of uncomplaining sacrifice. It is a powerful reminder that phishing is not just a threat to the "careless." It targets real people, people like Russell, and any of us.

Source: People Magazine – Russell Leahy’s story

What to Do If You Clicked a Phishing Link

In case you realize you've become a victim of phishing, swift and prompt action is essential to prevent damage:

- Immediately Change Passwords:

Change the password for the affected and all the related accounts.

- Enable/Strongen MFA:

If not done, turn on or strengthen multi-factor authentication on all accounts.

- Contact Financial Institutions:

If financial data (e.g., bank account numbers, credit card numbers) were affected, immediately contact your bank or affected service provider.

-

Report What Happened

You should tell people about the scam:

- Mark the fake email as spam in your email

- Report it to the real company they were copying

- In the US, you can report it to the FBI's website (IC3.gov)

-

Check Your Computer

If you downloaded anything or opened a file, scan your computer for viruses. Most computers have built-in protection, but you can also download free antivirus programs.

-

Watch Your Money

Check your bank account and credit card statements more often for the next few weeks. Look for any charges you didn't make.

Taking swift action can significantly limit the potential harm and assist law enforcement agencies in tracking and disrupting ongoing phishing campaigns.

Staying One Step Ahead of Scammers in 2025

Phishing will continue to evolve rapidly, driven by the growth of AI, global scams-as-a-service expansion, and even more sophisticated strategies of social engineering. The sheer volume, diversity, and advanced level of attacks in 2025 require always being on guard as your best defense.

By incorporating broad awareness training, using strong security tools, and using critical thinking for all online interactions, you can greatly reduce your threat. Even in contexts where phishing seems inevitable. Pass on this information to your family, friends, and coworkers. The more people who can see the warning signs and react, the more resilient our network is to these scams.

FAQs (Frequently Asked Questions)

Online phishing is a cyber scam where attackers pretend to be someone you trust (like your bank or a well-known brand) to trick you into revealing personal information or money. It's still a big problem in 2025 because scammers use advanced tools like AI-generated messages and Phishing-as-a-Service (PhaaS) to make their scams look incredibly real and convince more people to fall for them.

You can identify a suspicious phishing email by looking for a few red flags. Check if the message creates urgency or threats (e.g., "account locked"). Look closely at the sender's email address for odd spellings or weird domains. Always hover over links before clicking to see the real destination. Be wary if they ask for personal details like passwords, use generic greetings, or include unexpected QR codes or attachments.

If you clicked a phishing link, act fast! First, change your password for the affected account immediately, and any other accounts using the same login. If financial info was involved, contact your bank right away. Run a scan for malware on your device. Also, report the phishing attempt to your email provider and the company that was impersonated to help prevent others from being scammed.

Yes, there are several common phishing attack types. Watch out for classic email phishing, text messages (smishing) claiming urgent package or bank issues, and phone calls (vishing) from fake tech support or banks. Also, be aware of highly targeted spear phishing, scams on social media, and quishing (phishing using QR codes). Scammers are always evolving, so stay alert across all communication channels.

The most effective way to protect your personal information from phishing scams is a combination of awareness and security tools. Always think before you click and verify senders. Enable multi-factor authentication (MFA) on all your accounts. Keep all your software updated, use good spam filters, and regularly monitor your account activity. Educating yourself and others about the latest phishing tactics is your best defense.