- Cybersecurity

- September 10, 2025

Table of Contents

- What Fake Investment Platforms Really Are

- The Alarming Rise of Fake Investment Platforms

- Real-World Scam Example: The JuicyFields Ponzi Scheme

- Why Fake Investment Platforms Continue to Grow?

- Investment Scam Red Flag Checklist

- Spotting Scams Before They Cost You

- What to Do If You Have Been Scammed?

- Stay safe From Fake Investment Platforms

It often starts with a bold claim, “Earn 25% returns in just 30 days.” The platform looks professional and has reviews that sound real. There's even a representative ready to guide you through the process. Everything feels right, until it doesn’t.

Suddenly, you will see that your account is frozen, and the representatives are no longer reachable. When you try to withdraw your funds, there is always some issue; eventually, the platform will also disappear. What seemed like a golden opportunity reveals itself as a classic investment scam.

As digital tools become part of your daily routines, investment fraud is becoming difficult to spot and easier to fall for. From fake investment websites that copy legitimate firms to aggressive crypto scams promising fast profits, Scammers have refined their tactics of deception, making sure that everyone is vulnerable to their schemes.

This guide breaks down how these platforms operate, the red flags to identify, and most importantly, how to protect yourself before clicking “Invest Now.” Because when it comes to online investing, recognizing the signs of fraud isn't optional, it’s essential.

What Fake Investment Platforms Really Are

Investing online has never been easier. With just a few clicks, you can explore opportunities across stocks, crypto, real estate, and more, all from your phone or laptop. With everything moving online, smart investors like you now have more ways to grow your money and plan for the future.

But with this convenience comes a little risk, and it’s not the market volatility kind. It’s the risk of running into fake platforms that look real but are set up to steal your money.

Now, that doesn’t mean you should avoid investing altogether. It just means you need to be a little more aware about how to spot these fake investment schemes, and that’s exactly what this guide is here to help with.

To know what to watch out for, let’s start with what’s really happening out there.

The Alarming Rise of Fake Investment Platforms

Investment scams have risen sharply in recent years, mostly taking advantage of the easily available internet and the new digital lifestyle.

- $5.7 Billion Lost in 2024: According to the Federal Trade Commission (FTC), consumers reported losses totaling $5.7 billion to investment scams in 2024, marking a $1 billion increase from the previous year. (Webster First Federal Credit Union)

- 13,000 Fake Domains Detected: In January 2024 alone, cybersecurity experts identified nearly 13,000 fraudulent investment platform domains, indicating the vast scale at which these scams operate. (Netcraft)

- Crypto Scams Dominate: Cryptocurrency-related scams accounted for a significant portion of investment fraud, with losses reaching $3.96 billion in 2023, highlighting the growing exploitation of digital currencies.

Real-World Scam Example: The JuicyFields Ponzi Scheme

Understanding the true impact of fake investment scams requires looking at real-life cases. The case of JuicyFields is a high-profile case that exposed just how easily investors can be misled by platforms that appear legitimate.

At first glance, JuicyFields appeared legitimate. The site was professional-looking, the dashboards reflected healthy returns, and they even offered live-streamed video feeds of what appeared to be cannabis plantations in South America. Everything seemed professional and transparent, just the sort of thing to make potential investors sit back and think, "This has got to be real."

But behind the scenes, it was a traditional Ponzi scheme. The funds flowing to initial investors weren't profits; they were straight from new investors' wallets. By the time it all collapsed in 2022, over 186,000 individuals were caught up in the fraudulent scheme, with overall losses totaling a whopping €645 million, which amounts to $753.5 million USD.

The individual cost was devastating. people lost their life savings, retirement accounts, and college tuition payments, the type of financial blows that will take years to recover from. And emotionally, it was just as brutal. For many, the feeling of being misled, taken advantage of, and left with nothing was overwhelming.

The JuicyFields case also issued a stern warning throughout the broader online investing space, particularly in rapidly expanding industries such as cannabis, where hype tends to get ahead of regulation. It demonstrated how simple it is for businesslike platforms to deceive even prudent investors.

What should investors learn from this example? If something looks too good to be true, it probably is. Always dig deeper, ask the hard questions, and never invest based on appearances alone. A little skepticism can go a long way in protecting yourself from these sophisticated scams.

Why Fake Investment Platforms Continue to Grow?

You might wonder, if these platforms are fake, how are they fooling so many people? The truth is, scammers have gotten good at what they do. Let’s see why these scams are emerging everywhere, and such that even smart investors are also falling in their trap.

- It’s Easy to Set Up a Fake Website: Nowadays, anyone with basic tech skills can build a sleek, professional-looking site within hours. These scam sites often copy real investment platforms' logos, dashboards, and even live chat support, making it hard to tell what’s legit and what’s not.

- The Crypto Craze Makes It Worse: Let’s be honest, crypto still confuses a lot of people. It’s new, fast-moving, and full of big promises. Scammers know this and use the hype to lure in investors with lines like “Double your Bitcoin in 48 hours” or “Guaranteed crypto profits.” Sounds exciting, right? That’s the trap.

- Social Media Makes Scams Go Viral: Instagram, TikTok, and Facebook scammers are everywhere. They use paid ads, fake profiles, and flashy videos to look successful and trustworthy. You might see a “success story” or “friend” promoting a platform that seems to work, but it’s all staged.

- People Don’t Always Know the Red Flags: Despite all the alerts and news stories, many folks still don’t know what to watch out for. Scammers take advantage of this. They build fake trust using testimonials, fake licenses, and “support teams” that are super convincing.

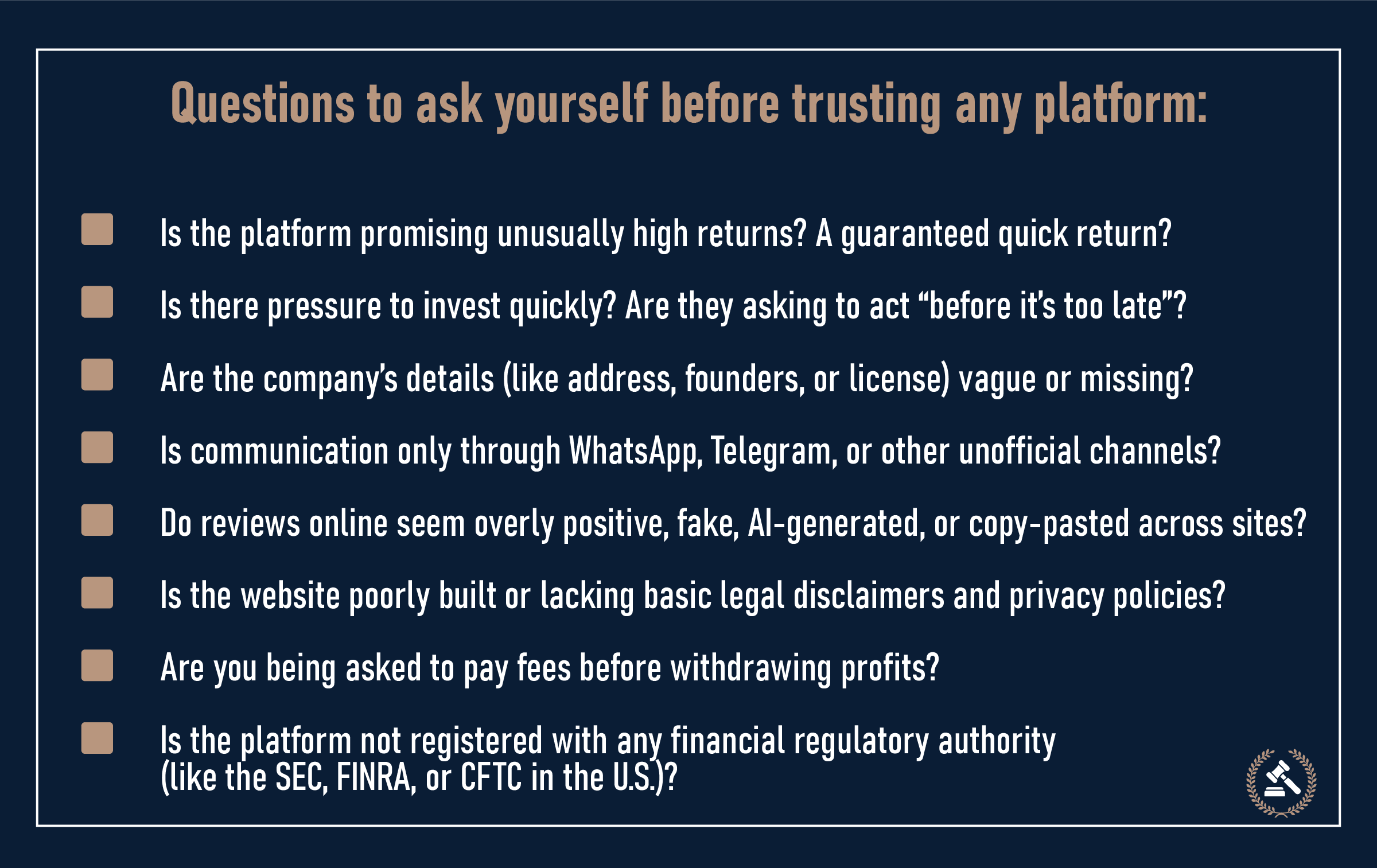

Before you trust any platform with your money, it’s crucial to know what to look out for. Scammers are getting clever, using smart tactics to appear legitimate, but if you know where to look, the warning signs are always there. Here is a checklist of some of the most common red flags to see if you're dealing with a fake investment scheme.

Investment Scam Red Flag Checklist

Questions to ask yourself before trusting any platform:

- Is the platform promising unusually high returns? A guaranteed quick return?

- Is there pressure to invest quickly? Are they asking to act “before it’s too late”?

- Are the company’s details (like address, founders, or license) vague or missing?

- Is communication only through WhatsApp, Telegram, or other unofficial channels?

- Do reviews online seem overly positive, fake, AI-generated, or copy-pasted across sites?

- Is the website poorly built or lacking basic legal disclaimers and privacy policies?

- Are you being asked to pay fees before withdrawing profits?

- Is the platform not registered with any financial regulatory authority (like the SEC, FINRA, or CFTC in the U.S.)?

If you answered “yes” to even one of these, take a step back, rethink everything, and reverify everything, even then, if you are not sure. Stop. These are major warning signs of a potential scam.

Spotting Scams Before They Cost You

You’ve seen the ads. You’ve heard the promises. Now here’s the truth. Scam investment platforms may look polished and professional, but underneath, they often run on the same predictable tactics. Once you know what to look for, spotting the fakes becomes a whole lot easier.

Below is a breakdown of the most common traits found across fraudulent investment schemes. If you notice more than one of these patterns, it’s time to walk away…..Fast.

Investment scams often follow a similar playbook. Knowing these common traits can help you spot them early and protect your money.

1. No Clear Investment Model

Where is your money going? How is it being invested? What’s the business model? Scam platforms often use buzzwords like “AI-powered trading,” “quantum algorithms,” or “global arbitrage” without any real explanation. If you can’t get a clear, logical answer to how returns are made, it’s time to walk away.

2. No Withdrawals, Just Excuses

One of the first signs something’s wrong? You try to withdraw your money, and suddenly, there’s a problem. Scam platforms come up with endless excuses: technical delays, unexpected fees, “pending approvals,” or identity verifications that go nowhere. The goal is to keep your money locked in until you give up or lose everything.

3. Regulatory License or Oversight

In the U.S., real investment companies are required to register with organizations like the SEC, FINRA, or CFTC. If the platform has no license, no registration ID, and no evidence of compliance, it’s not operating legally. Always check regulatory databases. If you don’t find the company listed, that’s a major red flag.

4. No Two-Factor Authentication (2FA)

Any platform handling your money should care about your security. The lack of even basic protections like 2FA is a red flag. If they’re not offering two-step logins, they either don’t care about your account or never intended to keep it safe in the first place. Learn the importance of 2FA in our complete guide on Two Factor Authentication

5. Unrealistic Returns Promised

Scammers use high-return promises to lure in users who are hoping for quick profits. No legit investment guarantees massive returns with zero risk. If a site promises to double your money overnight or offers “fixed returns” regardless of market conditions, that’s not an opportunity, it’s bait.

6. No Regulatory License or Oversight

In the U.S., real investment companies are required to register with organizations like the SEC, FINRA, or CFTC. If the platform has no license, no registration ID, and no evidence of compliance, it’s not operating legally. Always check regulatory databases. If you don’t find the company listed, that’s a major red flag.

7. Direct Contact & High-Pressure Tactics

Once you’ve signed up or shown interest, you’ll likely be contacted directly, usually via WhatsApp, Telegram, or email. These “advisors” or “account managers” will flatter you, pressure you to invest quickly, or warn you of “limited-time opportunities.” It’s all part of the hustle.

Real investment sites are transparent in their dealings. They disclose who they are dealing with, what they do, and how they operate. They’re registered, regulated, and they don’t make wild promises. When in doubt, stop there to verify everything and never trust a platform just because it looks professional.

And sometimes, even when you stay cautious and know the signs, things might still slip through the cracks. When you have been scammed already or you feel like you might have been scammed, it's okay. What really matters now is what you do next.

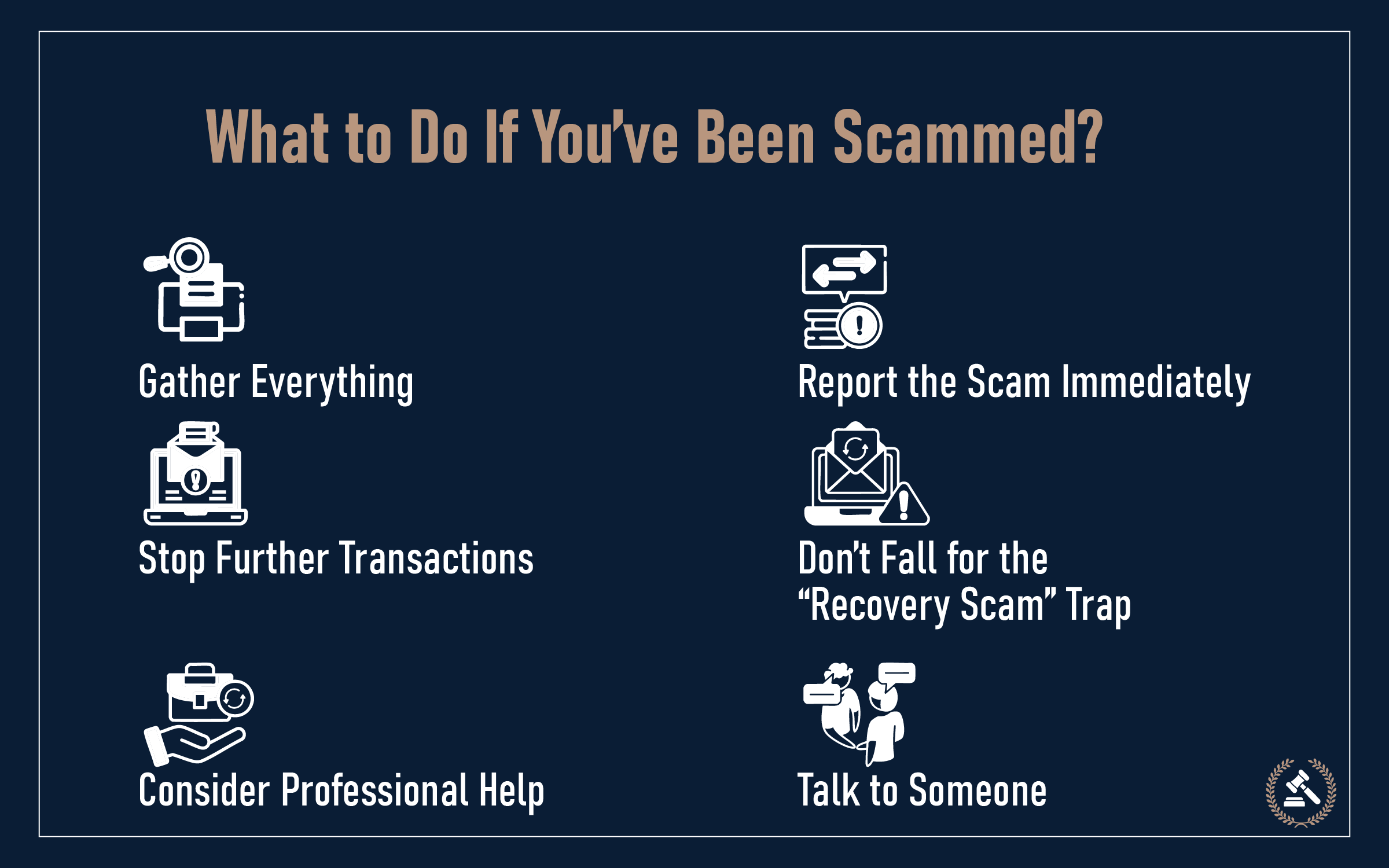

What to Do If You Have Been Scammed?

If you’ve been caught in one of these scams, take a deep breath, you’re not alone, and it’s not the end of the road. These schemes are designed to trick smart, careful people, and there’s no shame in falling for one. What matters most now is what you do next.

Here’s a step-by-step guide to help you take back control and start moving toward recovery:

- Gather Everything: Start by collecting all the evidence you can, screenshots of the platform, emails or chat messages, transaction receipts, wallet addresses, login details, anything that shows communication or money flow. The more organized your records, the better your chances when reporting or seeking recovery support.

- Report the Scam Immediately: File a complaint with your local and national authorities. These agencies track scam trends and may help with investigations. In the U.S., you can report to:

- - FTC (Federal Trade Commission)reportfraud.ftc.gov

- - SEC (Securities and Exchange Commission) if it's securities fraud

- - CFTC (Commodity Futures Trading Commission) for crypto and commodities-related scams

- - FBI’s Internet Crime Complaint Center (IC3)ic3.gov

- Stop Further Transactions: If you’ve shared payment information, crypto wallet details, or banking access, freeze those accounts. Call your bank, credit card provider, or crypto exchange to report unauthorized activity; they will prevent further losses and might also be able to reverse some transactions. Consider placing a fraud alert or credit freeze with major credit bureaus.

- Don’t Fall for the “Recovery Scam” Trap: Double-dipping is what scammers enjoy the most, i.e., once a scam is pulled, they return pretending to be "recovery agents" or government officers. They will tell you that you can recover money, but for a fee, of course. Don't believe it, as genuine recovery assistance never demands payment in advance.

- Consider Professional Help (Cautiously): Some crypto and financial fraud recovery services are legitimate, particularly those that employ blockchain forensics to follow transactions. Just be super suspicious, read reviews, confirm registration, and ensure that they don't request money first. A reputable company will describe its process in detail and provide a contract prior to proceeding with anything.

- Talk to Someone: Getting scammed can be embarrassing, infuriating, and isolating, but it shouldn't be. Speak to somebody you trust. You aren't alone, and just talking it through can clear your head and enable you to make better decisions in the future

Stay safe From Fake Investment Platforms

Scammers keep changing their methods, but you can stay ahead by staying informed. By knowing the warning signs, understanding how fake platforms work, and questioning offers that seem unrealistic, you lower your chances of being caught in a trap. Protecting your money also means protecting your peace of mind.

Online investing offers real opportunities, but the genuine ones hold up under research and careful checks. Take your time, ask the right questions, and don’t rush into decisions. If something feels uncertain, pause and review. Safe investing comes from patience and awareness.

FAQs (Frequently Asked Questions)

Check if it's registered with financial regulators like the SEC or FINRA. Look for third-party reviews and contact information.

Stop any further payments immediately. Report to the FTC, SEC, and local cybercrime units.

No, but many scams use crypto due to its untraceable nature. Always verify licensing and legitimacy.

It’s difficult but not impossible. File a complaint, document everything, and contact a verified recovery service.

Use well-known, regulated platforms, never trust guaranteed profits, and research thoroughly before investing.